💰The Fall Of A $28B Market Leader

For anyone born after 2005, it’s hard to believe that Amazon wasn’t always the top player in the world of E Commerce.

Just 2 decades ago, eBay was the ‘poster child for online selling’ with a $28B peak valuation.

But as of 2024, eBay is facing a 73% decline in sales over the past decade and is second to Amazon - one of 6 companies to ever reach a trillion.

Today, we’ll talk about what Amazon knew that eBay didn’t, and how they used it against them to take down a $28B market leader.

Here’s what we got for ya:

🛍 Amazon VS eBay

🧠 The Value Equation

🛠 The Pioneer Paradox

Read Time: 4 min 37 sec

🛍 Amazon VS eBay

eBay was the first global customer-to-customer selling platform.

They were like the Uber of 1995 - a cool new concept everyone was excited to make money with.

Their business is simple:

Consumers hop on eBay and list an item for sale.

Other consumers who want that item bid on it.

The item is sold and shipped to the highest bidder

Users have sold anything from broken laser pointers to grilled cheese sandwiches to $168M superyachts.

Within 3 years eBay went public and was making almost $50M a year.

In 2002, eBay acquired PayPal for $1.5B. Three years later they acquired Skype for $2.6B.

To outsiders, it seemed eBay would stay the king of online selling...

But behind the scenes, Amazon was growing at 5x the rate of eBay. By 2015, Amazon was making $93B more than eBay every year.

Before we get into Amazon’s exact playbook for their $28B takedown, you need to understand the difference between Amazon and eBay.

eBay is a platform that helps people auction their items to a global audience.

Amazon allows people to list items on their platform under their brand name at a fixed price.

And because of this small difference, Amazon was able to turn eBay’s users against them.

Let’s talk about how.

Have a business or something you want to promote in front of 65,000+ readers?

Click the button below to apply now!

🧠 The Value Equation

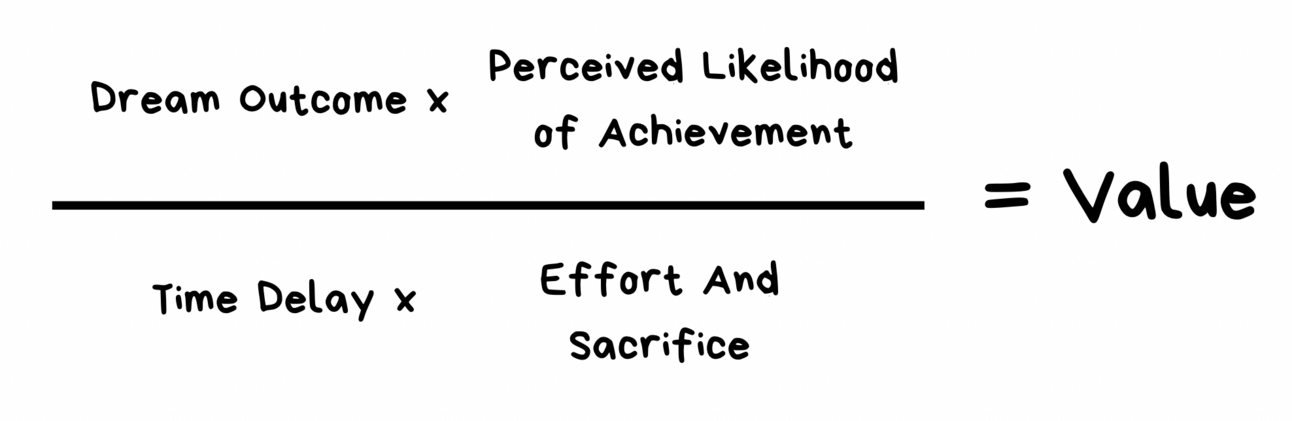

In a nutshell, Amazon beat eBay because their business model allowed them to become more valuable to customers at a faster rate.

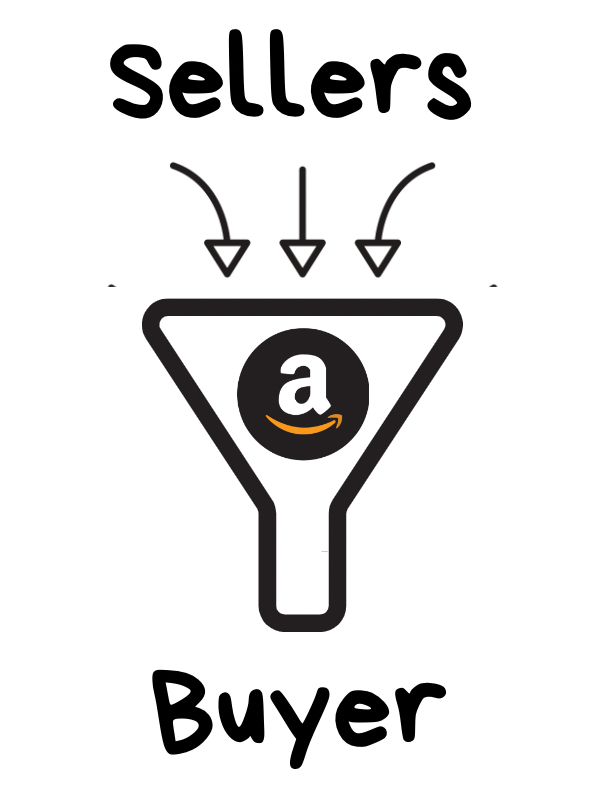

I think the best way to see this is with The Value Equation from the book $100M offers:

#1 - Dream Outcome

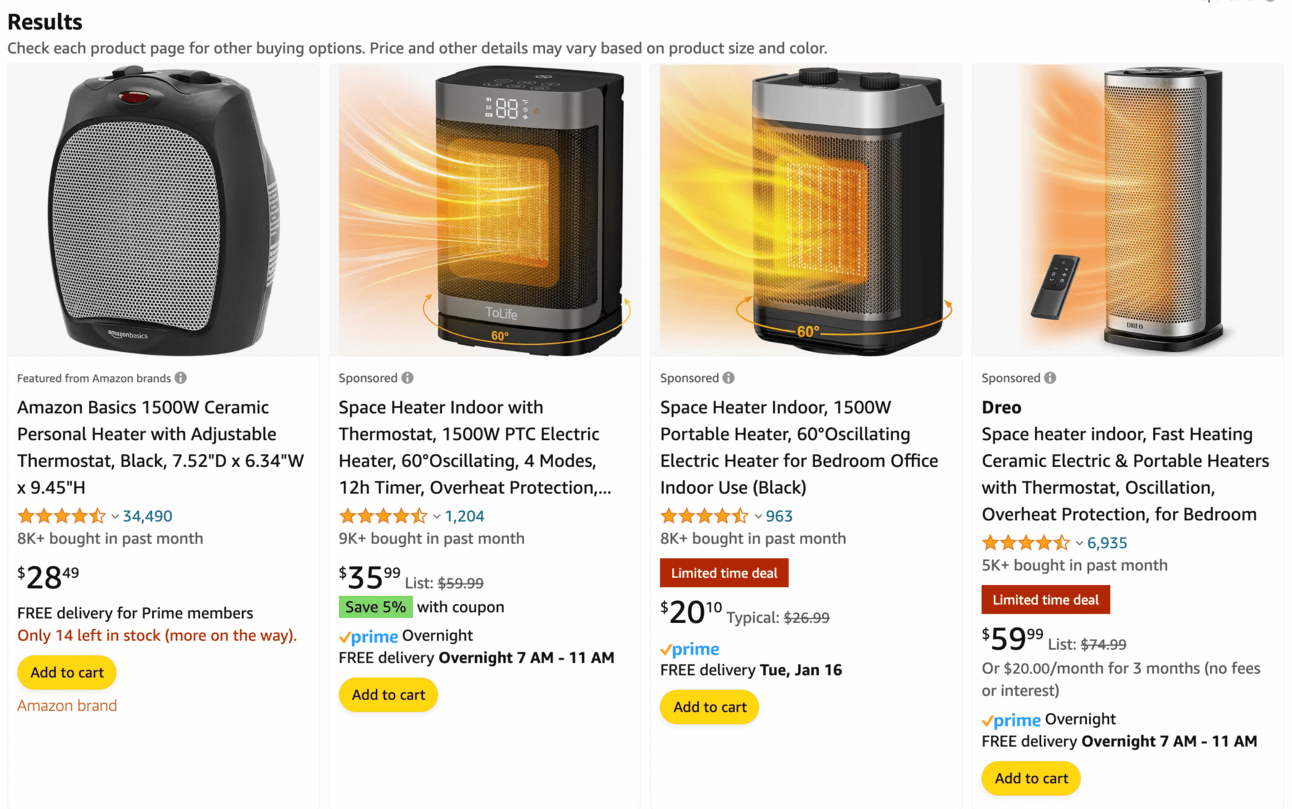

Buyers want an item that’s high quality at a low price.

Knowing this, Amazon puts sellers in endless competition to sell the best products at the lowest price.

But with eBay, it’s whatever the seller is willing to sell it at.

#2 - Perceived Likelihood of Achievement

Again, eBay is C-to-C. Buyers are bidding on items bought by other consumers.

So there is technically no guarantee that the buyer will not be scammed.

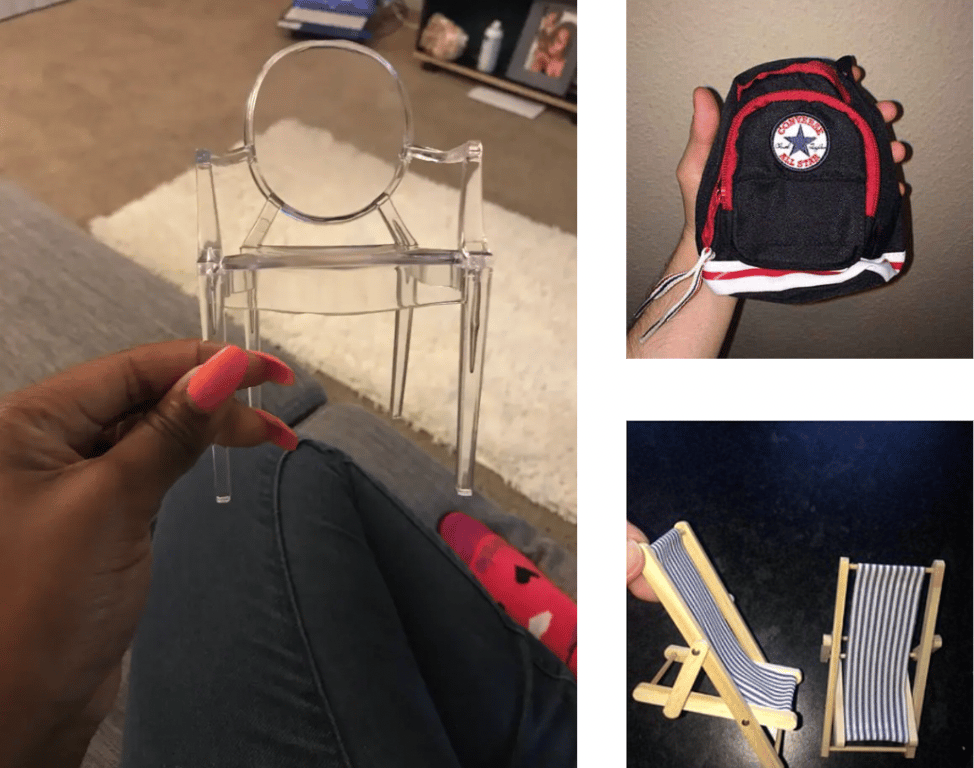

There are certainly some horror stories…

(Sellers aren’t always transparent about size)

But with Amazon, items are sold under the Amazon brand. So every time a product is not up to par, Amazon takes a hit.

So Amazon requires:

High-quality product images with a white background

Standard landing page

Free returns no questions asked

With Amazon, buyers can trust a brand. With eBay, buyers have to trust a random seller from Ohio.

#3 - Time Delay

With eBay, you get your package when the seller can make it to the post office on their day off.

But with Amazon’s fulfillment center network, you’re promised 2-day shipping with Prime.

#4 - Effort & Sacrifice

When I want socks from Amazon, the process looks something like this:

Search socks

Do a quick scan to find the cheapest pair with respectable quality

Click ‘order now’

Done.

But when using eBay…

Search socks

Go through each seller for 30+ min and try to find an unused pair

Find a seller that kept the tags on them

Scroll through the photos until I’m 99% sure they’re ok

Place a bid

Etc, etc..

(Not that I'd buy socks on eBay but you get the idea)

Significantly less effort paired with lower prices became Amazon’s deadliest weapon against eBay.

The MAYA Theory - How to sell what your audience really wants (4 min)

🛠 The Pioneer Paradox

This isn’t the first time we’ve seen this happen. Most ‘Pioneer Business’ (New Market Leaders) don’t last.

Yahoo! ($318B peak) -> Google ($1.7T)

Blockbuster ($5B peak) -> Netflix ($213B)

MySpace ($12B peak) -> Facebook ($562B)

In his book The Innovator’s Dilemma, Clayton Christensen compares a few Pioneer Businesses and why they failed.

He found that all 3 fell on a similar timeline:

#1 - The Discovery. New tech is found and a new market forms

#2 - Established ignorance. Big companies don’t bother with the new tech, following the “if it ain’t broke, don’t fix it” mentality

#3 - The Opportunist. A startup with nothing to lose finds a new market and takes the opportunity

#4 - The Formation. Startup picks up traction in the new market and takes some of the market leader’s market share (but nothing too serious)

#5 - The Takeover. The Market leader realizes they’re losing and tries to adopt the new tech but it’s too late.

What stuck out to me is that the market leaders did not do anything wrong.

It’s not like they had an “I’m the best and you’ll never beat me” complex. They simply made data-driven decisions and minimized risks.

So could eBay have made a few changes to stay in the lead?

For sure.

But would they have been able to stay ahead of Amazon’s high-tech platform and ability to take on liability risks?

Probably not.